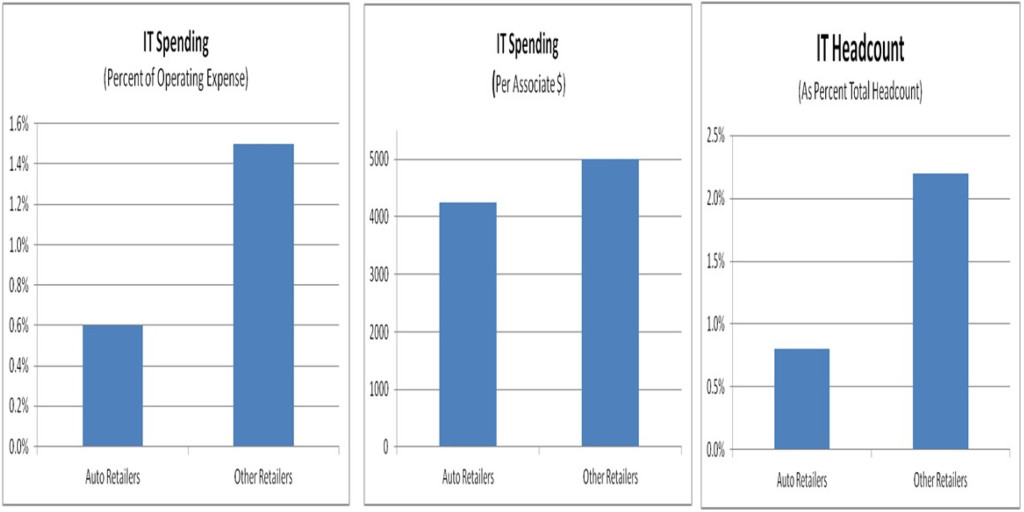

According to Gartner Group benchmarks, most auto retailers trail other retailers in IT spending levels from several perspectives. At the most macro levels, auto retailers under spend as a percent of operating expense, suggesting missed opportunities to create greater operating leverage. In addition, they underinvest on a per associate basis; limiting opportunities to improve associate productivity.

Overview

IT will play a critical role in achieving the business transformation demanded by today’s auto retailing environment. Changing margin structure, growing marketing complexity, an evolving workforce and rising customer expectations are driving toward greater reliance on technology to streamline processes and deliver a superior customer experience while gathering and utilizing data to protect margins.

Industry leaders will not be able to rely solely on off-the-shelf automotive solutions to power their business. Instead they will need to customize and integrate a combination of automotive, global and internal solutions to achieve their goals. Not only will this require increased investments over historic levels, but will require new skills, new partner relationships and new governance to efficiently and effectively manage the investments.

| Issue | Implication |

| Changing Margin Structure | Greater transparency and OEM margin structure assure profit no longer in “deal making” but in optimizing inventory and pricing |

| Growing Marketing Complexity | Optimizing across old and new media requires more sophisticated analysis and management tools |

| Evolving Workforce | Integrate point-of-sale systems to achieve productivity and work environment expectations required to attract new entrants |

| Rising Customer Expectations | Movement toward true eCommerce is inevitable requiring a seamless, on-line / off-line process |

| Streamline Processes | Those who have effectively utilize outsourcing and shared services to achieve scale and skill benefits will have a decisive advantage |

| Superior Customer Experience | High acquisition costs and large differences in value will be place premium on recognizing and tailoring offerings to best customers |

| Gathering and Using Data | With less margin for error, market insight and its application becomes more important |

A. Spending Level and Mix

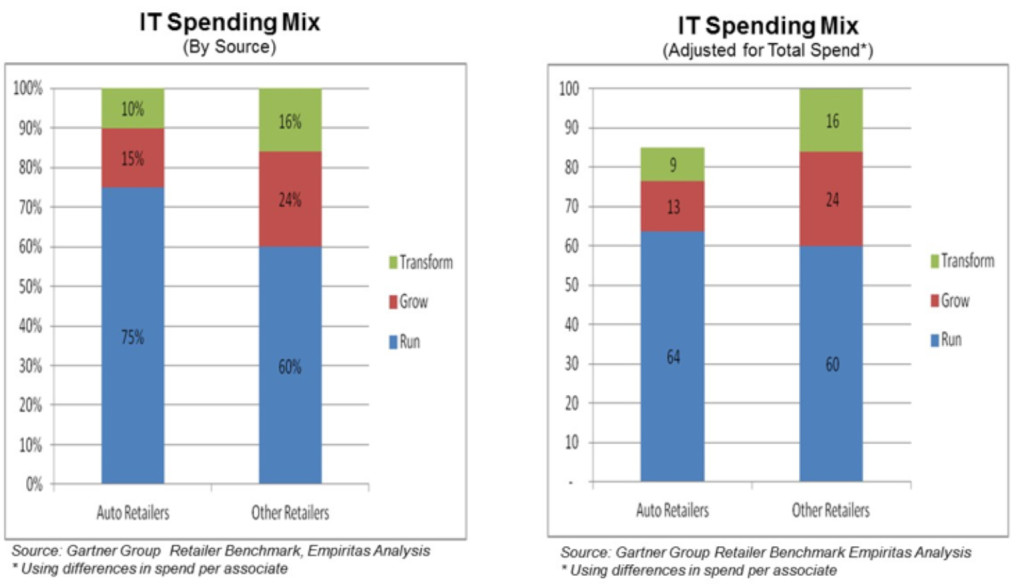

While most auto retailers have recently increased their technology budgets as business has recovered, most still tend to manage IT budgets as an expense to be minimized, rather than an outcome arising from strategic priorities. The change in mindset starts with recognizing IT serves three distinct purposes and each purpose needs a different management approach. These purposes are: (1) RUN, support for daily business operations, (2) GROW, improvements in current business processes, and (3) TRANSFORM, investments in new business processes and models.

According to Gartner Group benchmarks, most auto retailers trail other retailers in IT spending levels from several perspectives. At the most macro levels, auto retailers under spend as a percent of operating expense, suggesting missed opportunities to create greater operating leverage. In addition, they underinvest on a per associate basis; limiting opportunities to improve associate productivity.

Auto Retailing IT Strategy

A. Overall Spending

All benchmarks are fraught with difficulties. When comparing IT intensity across retail segments, we need to take into account the relative severity of the Great Recession, as well as where the segment is in its transformational lifecycle. While most retail segments have largely recovered from the Great Recession, automotive still remains below 2007 revenues. Therefore, we can expect IT intensity to lag somewhat. In addition, most other retail segments are ahead in the transition from a store-centric to a process-centric business model. So these higher spending levels may reflect either the intense transitional spend, auto is just beginning, or the resultant business model where IT has displaced physical investment and labor.

*Source: Gartner Group and Empiritas Analysis

*Source: Gartner Group and Empiritas Analysis

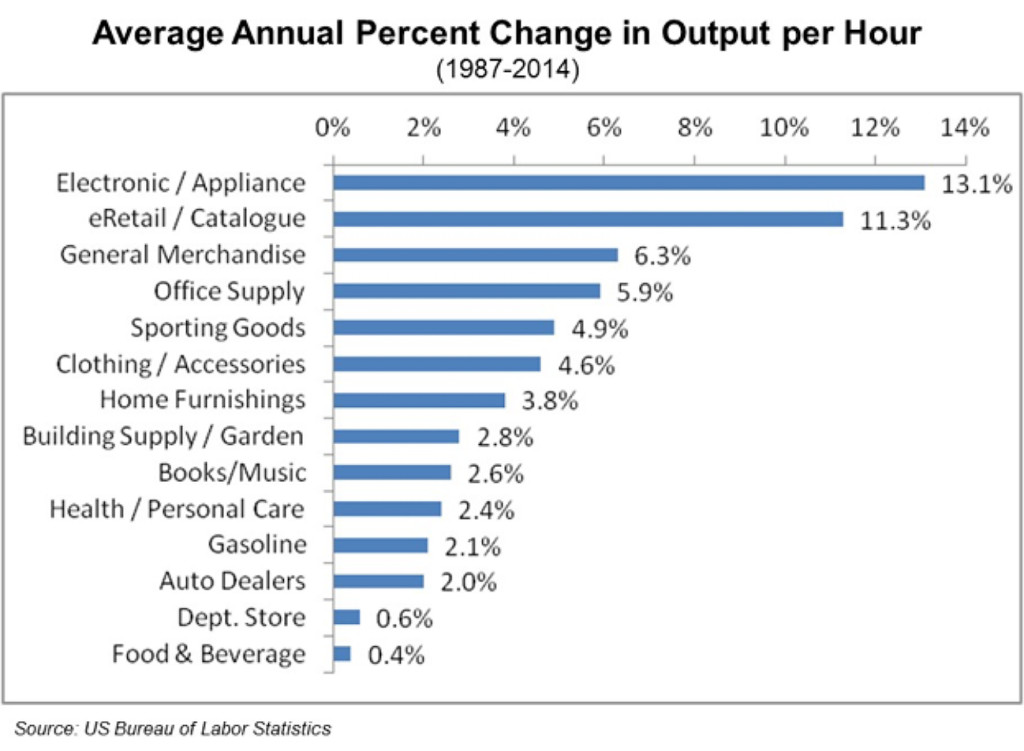

In any case, auto has historically underinvested in technology, and this underinvestment has had consequences on productivity growth relative to other retail sectors. This difference is more than an academic curiously because such a long-term gap drives the segment’s ability to pay and hence compete for talent. An auto retail sales position was a good middle-class job in the 1970s when many of today’s leaders entered the business; many sales people struggle to earn a decent living, contributing to the industry’s high turnover. Furthermore, outdated technology makes jobs less desirable for millennials who often judge businesses based on the technology with which the interact. Some of this is cultural and some very practical because they want relevant job skills. Consequently, the industry is not attracting the talent to execute today’s business, but perhaps more importantly, it is not attracting the talent needed to lead auto retail into the future. Therefore, closing the investment gap is imperative.

B. Spending Mix

B. Spending Mix

More important than the overall spending gap is the difference in auto retailers’ spending mix compared to other retailers. Gartner categorizes IT spending into three major categories; run, grow and transform. Run includes IT resources focused on continuing operations; such as DMS, data center, core business applications, reporting, telephony and network expenses, usually representing all the non-discretionary expenses. Grow includes developing and enhancing IT systems in support of earnings growth; such as investments to gain operating efficiency, attract more customers or achieve greater revenue per customer. Transform includes costs to enable new business models; such as investments designed to leverage scale and skill above the store level. The auto segment’s spending is heavily weighted toward run, effectively crowding out growth and transformation spending. This has a major impact on the ability to maintain pace with other segments in achieving a competitive cost structure and consumer experience.

Without substantially altering the spending mix from Run to Transform, auto retailers will find it increasing difficult to adopt and develop the date-driven business models which have transformed other retail sectors or create the efficient, tailored and transparent process that consumers expect. Not only does that impact labor productivity, but leads to vastly inefficient use of capital through inflated inventories and lower profit margins through inadequately matching consumers and products and lower customer retention.

C. Managing Run Spending

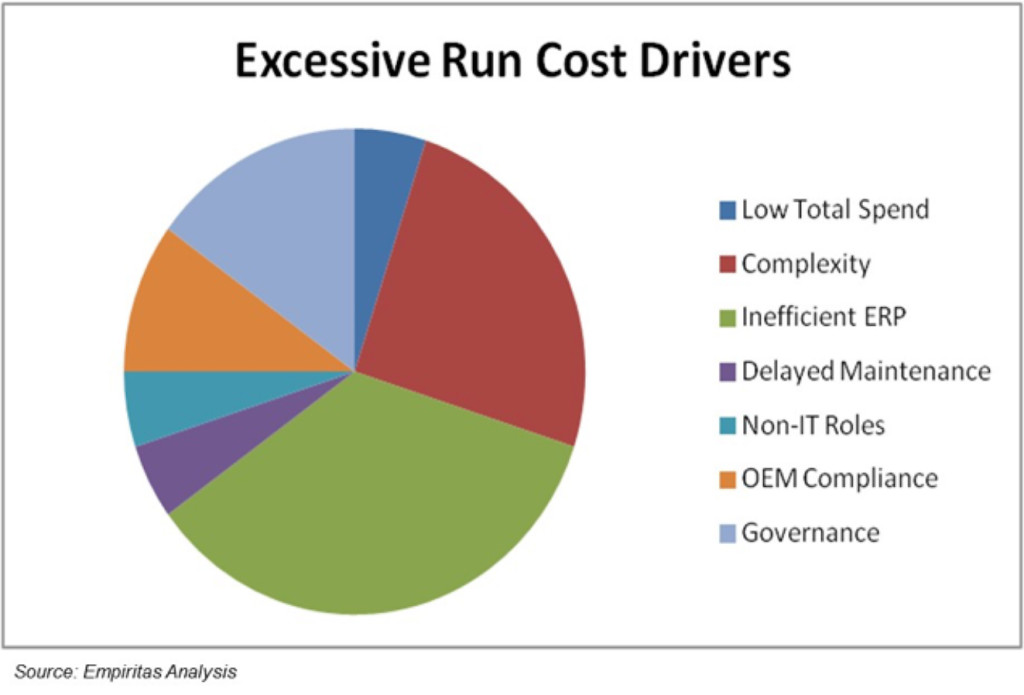

There are several factors that drive the over weighting of run spending compared to other categories. Among those factors are:

- Low Total Spending (5%). Run spending is not discretionary, other than in the very short run, so the spending reductions required to survive the Great Recession were disproportionately borne by delaying growth and transformation initiatives. As normal spending patterns return, run expenses should decline on a relative basis, as discretionary spending increases faster than base requirements.

- Complexity (25%). While most major retailers have consolidated major IT systems, there is often significant variation at the store level. Even when stores share the same application footprint there are often too many point solution providers. This complexity drives support and maintenance costs and slows growth and transform initiatives by requiring custom integration. In addition, the highly customized environment inhibits the ability to take advantage of product upgrades offered by component solutions.

- Inefficient ERP (35%). Most retailers spend less on ERP than auto spends on DMS. In addition, the underlying technology, architecture, and data structure increase maintenance, growth and transformation costs. For example, maintenance and enhancements require specialized developers who command a premium and are difficult to offshore. In addition, the data structure and architecture impose higher direct costs through more complex integration, compared to well-defined APIs; and higher indirect costs are imposed on multiple business partners requiring DMS access. Finally, specialized user interfaces drive higher training costs and slow adoption. While major providers are moving to address, progress remains slow and competition inadequate to drive pricing lower.

- Delayed Maintenance (5%). During the Great Recession upgrades were delayed leaving many systems on unsupported versions. Not only does this cause operating issues and create more failures, but also increases the maintenance and enhancement complexity.

- Non-IT Roles (5%). In many organizations, IT performs functions more appropriately done in operating departments, in part because systems have inadequate administration or content capabilities requiring development talent.

- OEM Compliance (10%). Few retailers face the complexity of OEM compliance standards that directly and indirectly impact costs. By going beyond functional standards to specifying specific solutions, often unique to their brand, they impede the ability for multi-brand retailers to generate scale benefits

- Governance (15%). Productive spending is often crowded out by business requests that do not impact business, particularly with regards to messaging reports or validating data better addressed upstream or in the business unit.

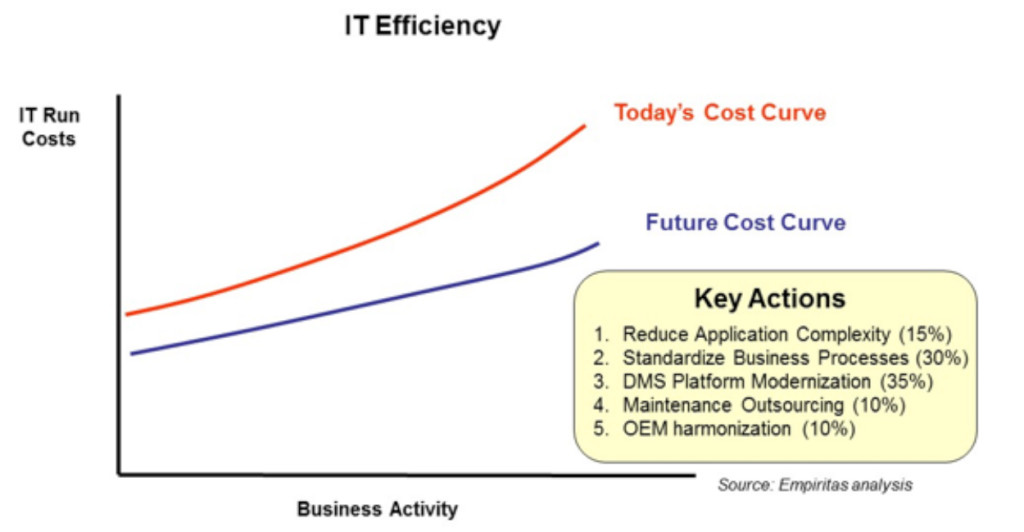

Our goal should be to bend the maintenance curve as a function of business activity, increasing our scale advantage. There are several actions auto retailers can take to impact run costs:

- Reduce business application complexity (15%) by consolidating business solutions around fewer, more capability partners that conform to strategic partner requirements. Auto retailers need to create a store technology template with business driven variation. There need to be explicit standards for hardware, software and network requirements for each store determined by size, brand, and other business characteristics. A concerted effort to drive standardization will lower costs by reducing complexity and duplication, and reduce rates through purchasing leverage. Moving the technology stack to a common, leading platform can exist significantly in this effort.

- Standardize processes and reporting (30%) wherever possible. Reducing the variations in business processes that need to be supported can dramatically simplify IT support efforts. Too often customizations are “free” to the user, so there is no incentive to adhering to a common footprint. Customizations in process need to be restricted to clear business drivers rather than preferences. In addition to IT cost savings, there will be significant operating cost savings, as groups better realize advantages to scale and skill that are currently stymied by excessive variation. There will be a short-term cost to transition to common processes, but the pay-off is usually rapid.

- DMS platform modernization (35%). Each retailer needs to clearly articulate the requirements and hold its DMS provider an internal IT financially accountable to platform improvements that reduce customization and enables plug-and- play environment for other IT partners. In addition, the prevailing per store pricing model limits scale benefits available through an ASP model and is an anachronism dating back to the server based cost structure. Industry leaders should explore alternative pricing models that more equitable share scale benefits and encourage both parties to focus on eliminating non-value added costs.

- Maintenance outsourcing (10%) by bringing applications to common, up-to-date standards maintainable by readily available skills, reducing complexity and improving processes. Few auto retailers have realized the benefits from outsourcing (either onshore or offshore) other retailers have achieved. First, more functions need to be centralized, platforms consolidated and processes standardized, so that outsources would prove profitable.

- OEM harmonization (10%). There has yet to be a concerted effort to quantify the collective impact of OEM mandates on the retail system. All auto retailers and their technology partners have an interest in moving to an approach where OEMs specify capability requirements, but allow retailers to select among qualified suppliers. Properly managed the results would be a greatly enhanced supplier network that could provide a more integrated solution, providing a superior customer experience at a lower cost.

D. Manage Grow Spend

The key to managing Grow Spend is a focus on delivering ROI. ROI delivery starts with a clear strategy that defines how value is created in each business area and determines the required processes and enabling technology to produce profit. The business case needs to be a living document, not just an approval document. Managing Grow execution has many challenges including:

- Operating Strategy Consensus. Because most dealer groups have grown through acquisition or been managed as a loose confederation, there are often wider variances in business practice than dictated by business requirements. The large variance in operating strategy complicates partner selection and IT development by making selection criteria conflicting or excessively broad or requiring significant customization to match each preference. Not only is the customization expensive, absorbing valuable resources which could be deployed against other issues, but often precludes our ability to benefit from upgrades. In addition, our operating strategies are often not sufficiently comprehensive.

- Operating Strategy Completeness. Most dealers look for solutions to immediate problems, rather than a more comprehensive solution taking into account the whole business. This leads to point solutions rather than optimizing an entire workflow. For IT this increases complexity, as point solutions need to be integrated into a single workflow. It also raises costs through system duplication and redundant effort, as most point solutions overtime grow to overlap other solution in pursuit of growth. Operationally, it raises job complexity requiring associates to learn multiple systems, and is often ineffectual as problems solved in one area, create others elsewhere.

- Program Management. Impatience to produce results quickly often leads to too many projects, frequently single threaded through a few key resources and frequently without dedicated program management resources. The result is delays arising from key resource bottlenecks, often without a clear ROI or comprehensive plan to guide priorities. In addition, most auto retailers have limited program management skills that have the experience planning and managing complex change efforts, nor are these skills prevalent among the traditional partner base. To the extent that program management skills exist with auto retailers, they are typically located in IT, and hence there is a bias toward IT development planning with insufficient effort into planning process change, job redefinition, and training.

- Budgeting. Because IT is not usually managed as a strategic resource, there is often no clear linkage between expected business unit operating results and the IT investments required to achieve those results. Today, most business area budgets are set prior to final commitment of the IT budget to specific projects. From an operational standpoint, grow investments should be included in each business area’s budget, not the IT budget. Not only does this drive greater accountability to achieving results from each investment, but also it does not artificially limit IT investments when there may be strong business reasons to continue investing.

- Maximizing Impact. Costs and impact can be maximized by utilizing off-the-shelf technology and leveraging the best practices imbedded in the technology workflow, reducing customization to the few unique attributes that drive business value for the individual retailer. Too often, auto retailers over customized packaged solutions and spend development dollars on preferences or accommodating special cases which may be better handled outside the standard workflow. The bias needs to shift to accept standard best practices. To the extend technology decisions are driven by a clear operating strategy, rather than a desire to add particular features, the more likely the result will be a cost effective solution.

- On-going Project Management. Most companies under invest in on-going project management to assure consistent implementation and business case realization. Clear expectations for roll-out timing and benefit realization milestones need to be set and measured. Deviations need to be understood and investigated to understand systemic from specific issues, so that implementation can precede on as rapid a pace as practical. Individual stores and managers need to be held accountable to realizing the benefit from these investments. While there are many techniques, immediately changing budgets, pay plans and performance expectation to reflect the business case and timing is among the most effective.

E. Manage Transform Spend

Transform spend should be managed similarly to Grow spend, only differing in its breadth and management complexity. Like Grow, Transform spend needs to be clearly guided by an ROI and must be executed by the strongest Program Management talent available to the organization.

- Clear Vision. To be successful, a transformation project needs a well-understood consensus con the future operating structure, including the rationale for change. Identifying and prioritizing all the changes which that must occur, including technology, process, skills, pay plans and partner relationships is by far the hardest aspect of transformational projects and the most likely source of delay and failure.

- Budgeting. Almost by definition, Transform projects are cross-business unit and therefore should be budgeted separately with all participants owning joint responsibility. Given the strategic nature of these projects, they should be shielded from the normal efforts to manage monthly and quarterly results. Only changes in the underlying assumptions that gave rise to the project or new information learned through project execution should alter the project budget, scope or timeline.

- Partners. Because auto retailing trails other retailers in transforming its business model, this is one area auto retailers should strongly consider external solutions. Not only may there be off-the–shelf technology available, but there may be significant opportunities to learn from the pains of other retailers in solution design and change management.

F. Impact of Dealer Services Industry Structure

The Dealer Service’s Industry structure is at the core of the auto retailer’s inability to maximize its return on IT investments. The Dealer Service’s industry is built around industry-specific ERPs optimized for an outdated business model. Therefore, significant effort is required to support more consumer-oriented workflows, particularly in a multi-store, multi-channel environment. These challenges are compounded because the major providers, isolated from competition, did not keep pace with several fundamental technology trends that have transformed solutions in other industries. Among these trends are service oriented architecture and open platforms built on modern languages.

The inability of the DMS providers to adapt in timely fashion has given rise to numerous point solution providers who emerged to solve particular problems with narrow business applications. Recognizing ERP alone would not provide growth; DMS providers expanded into business applications; sometimes through organic investment, but more often through acquisition. Unfortunately, in either case they generally bolted on applications to the existing workflow, rather than re-engineering the workflow. The result is a complex code base that slows development and underperforms leading point solutions. From a user’s perspective this yields inefficient business processes with significant rework and a complicated industry-specific UI that requires unique training. In addition, auto retailers are tasked with spending precious resources on systems integration rather than value added enhancements. Furthermore, the Dealer Service industry overall has locked itself into unique solutions that fail to adequately take advantage of broader IT innovation waves.

Since inherent technology challenges handicapped the DMS providers relative to point solution providers, DMS providers embarked on a strategy predicated on leveraging integration to the dealers’ data resident in the DMS as a source of competitive advantage in business applications. The result has been further inefficiencies as each point solution must pay separately for integration. Not only is this an unnecessary expense, but it interrupts a more natural a workflow outside the DMS; thereby bypassing the archaic DMS workflow. Unfortunately, because DMS provider business applications were constructed or purchased as point solutions, they also do not realize the promise of integrated workflow. Therefore, the integration promised by DMS providers is often no more “native” than those offered by third party point solution providers, only less expense.

DMS provider’s strategy in this space runs counter to auto retailer needs. DMS providers offer a portfolio of often less expensive, yet less capable business applications around an expensive ERP core; while precluding a truly integrated workflow to optimize productivity and customer experience. The industry would be better served by a lower cost ERP that provides an open architecture for retailers to select and integrate point solutions into a superior workflow. Then DMS providers could compete against point solution providers by offering a more comprehensive workflow suite that eliminates the need for a retailer to across multiple providers. Competing on integration across processes, rather than between solutions and the DMS, is the win-win solution these providers need to embrace.

Leading auto retailers have the most to gain from altering the industry structure because the current structure denies them the scale and skill benefits available to other large retailers. Collectively, they have the interest, scale and ability to drive the required changes through concerted pressure on existing providers or injecting new competition into the market.