Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Even once there is a development of a prototype there are three main challenges to mass adoption facing the market today. The first is the large costs to both the consumers and the manufacturers. Hardware and software costs today are estimated to be around $75,000, which is 2.5 times the average cost of a vehicle today. In addition OEMs will most likely be held liable for accidents involving self-driving cars. The next large obstacle is consumer acceptance of the technology. Heavy media attention to the first failures in the technology may cause consumers to reject the technology. Thirdly, cars today are seen as a status symbol and part of self-identity. The first autonomous vehicles would be limited in body style and type and therefore may be rejected by those who have high preferences for specific body styles and brands.

Although it may be a long time before there is a widespread acceptance of self-driving technology, there are large potential benefits and impacts for society. The first would be a reduction in traffic accidents and accident related deaths. Today there are 11 million accidents in the United States every year that result in 33,000 deaths and $300 billion in additional costs. In order to reduce these costs complete self-driving capabilities are not necessary, but will result in the largest impact. In addition self-driving vehicles would allow for additional leisure travel by improving the travel experience. Also there will be a reduction in short flight traffic because driving will become more preferable. People will be able to travel on their own schedule and avoid the extra stress of airports. Traffic will also decrease if there is a full adoption of autonomous vehicles. All vehicles on the highway could then break and accelerate in unison, reducing traffic backup.

Self-driving cars would also have impacts on asset utilization. Today vehicle utilization is around 10% of its maximum capability. Therefore with self-driving vehicles that are publicly owned vehicle utilization would increase. However, this is limited by high demand during rush hours. Also self-driving vehicles could decrease the cost of ride sharing services, which in turn would decrease the use of public transportation.

There are also personal benefits for individual consumers. One such benefit would be increased mobility for the elderly and disabled. These individuals could regain control of their own mobility and not rely on other forms of transportation. This also means that there will be an increase in consumer base because these individuals who could not previously use personal cars can now. Also there would increased leisure or work time for individuals. Instead of having to spend 45 minutes operating a vehicle to work, an individual could spend those 45 minutes doing other things while riding in his self-driving vehicle.

The current state of autonomous vehicles however is not even close to a fully functioning prototype. Today there still isn’t even a product with fully functioning self-driving highway capabilities. Highway driving is seen to be the easiest application for the self-driving technologies, but the technology is still not fully functioning in all weather conditions. The truth is that there are still huge limitations in the technology that will be incredibly difficult to overcome. Elon Musk, who is large proponent of autonomous vehicles, stated “My opinion is it’s a bridge too far to go to fully autonomous cars. It’s incredibly hard to get the last few percent.”[1]

Beyond the challenges facing consumer adoption, there are still large limitations in the technology itself. There will need to be large scale changes in road infrastructure that will need to be tailored to sensor technology. Today road signs, traffic signs, and other markers are designed for human eyes. There would need to be changes made on almost all of the 4 million miles of road in the United States in order for self-driving technology to be able to function maximally. In addition today’s sensors have difficulty during rain and snow. Therefore these vehicles will not be able to perform in all weather conditions yet. Also self-driving technology could be subject to hacking or viruses in ways that other technology currently face. Therefore this could lead to large scale safety issues that would lead to less drivable hours by the autonomous vehicles.

Despite all of the challenges there are still large investments from OEMs, technology companies and ride-share apps, like Uber. Currently OEMs, like Mercedes, are using their self-driving prototypes for advertising in order to display the “innovative image” of the brand. However all three of the business types are investing in self-driving technology in order to achieve a larger impact on the market. Although increasing autonomy of vehicles may lead to decreased numbers of vehicles it will also lead to higher turnover is the publicly owned vehicles. Therefore OEMs do not face as large of a negative impact that would have been originally thought.

The automotive industry will continue to step toward a self-driving future through advanced autonomous features. Private ownership will continue for the foreseeable future even once self-driving vehicles become available for many of reasons discussed including cost, American lifestyle, and the technology adoption curve.

However once we have fully autonomous vehicles, the benefits will be tremendous. For the average American this could mean an extra 45 minutes to their day. Given most people are awake for 16-18 hours per day, this is a dramatic improvement in time spent being productive (or not). It will be up to the consumer to choose how to use their time spent commuting. Additionally, we have an aging population that will benefit from self-driving vehicles. This will allow people mobility beyond that available today.

The future is bright with self-driving vehicles. However the road to complete autonomy is long and filled with many challenges.

[1] Financial Times. Tesla moves ahead of Google in race to build self-driving cars. http://www.ft.com/cms/s/0/70d26288-1faf-11e3-8861-00144feab7de.html#axzz3oYxc8IBn

]]>Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Situation

Creating business value does not always equate to creating market value. Business value creation is a two-step process. The first step is to create customer value. Many businesses in our industry fall short on this dimension, wasting precious resources on fighting the “feature function battle”, where companies mimic competitive offerings without considering how each will drive dealer profit. The second step is to deliver the value in a business model which captures and retains maximum value. The industry has focused on a very limited set of business models, preferring monthly per store subscription rather than pay-for-performance. These models become vulnerable to the scale negotiating power exercised by larger groups, particularly when delivered through a SaaS model with low per store variable cost. Gain share models not only refocus pricing on value over marginal cost, but also serve to guide on-going development, which reduces wasteful investments. Furthermore, dealer service providers are more likely to capture value from product enhancements than in more traditional business models where enhancements are often used to support retention and core product price enhancements. Finally, financial markets and buyers appear to distinguish between business models when valuing business performance.

Case Study

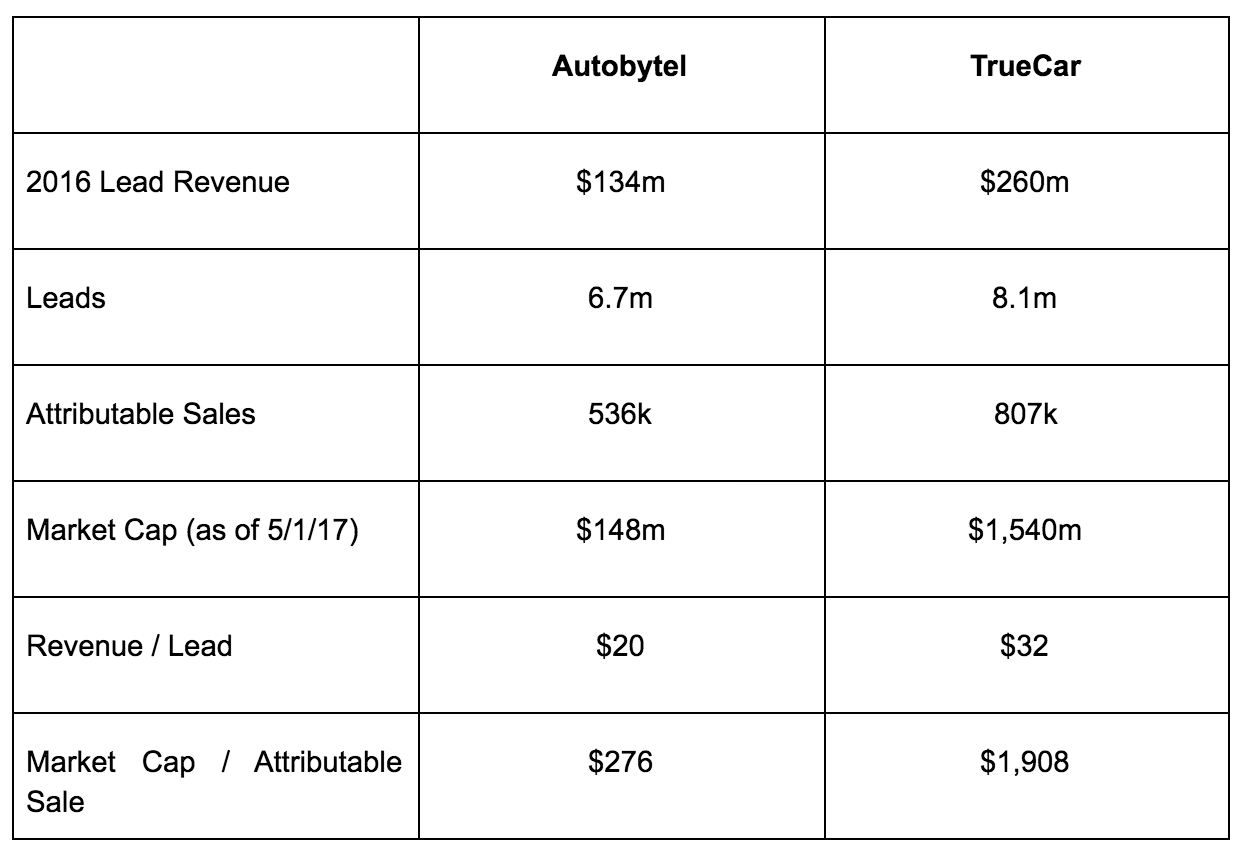

Autobytel and TrueCar are essentially in the same business, providing dealers with sales leads. Their leads do not perform remarkably differently in terms of close rate, yet TrueCar is able to command much higher effective revenue per lead and dramatically outpace Autobytel in market value per attributable sale. The 6.9 times greater market value creation is despite Autobytel having moderately positive cash flow and TrueCar still negative.

While there are many reasons TrueCar is more highly valued than Autobytel, most are driven from their differences in business model that position TrueCar differently in terms of future growth prospects and market perception as a “digital retailer”, as opposed to a “lead provider”.

Implications

When developing new capabilities, dealer service providers need to carefully assess the business model used to capture value. Defaulting to the prevailing model can lead to significant value leakage.

]]>

Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Operational Alignment is key to Service Marketing success. Service Marketing does not exist in a vacuum any more than Vehicle Marketing. We have observed a 3X difference in performance across same brand stores running the same marketing play. In many cases the poor performing stores had a negative ROI on marketing and demanding either a new vendor or a cut in marketing expenses. Upon closer inspection we found various operational constraints which limited success, including poor appointment handling processes, restricted appointment hours on the online scheduler, poor selling skills and additional service request offers not aligned to consumer needs. Addressing these operational issues first will dramatically improve marketing performance.

Consumer expectations are being shaped outside our service lanes. Consumer are experience new processes and technology that drive more efficient time management, personalization and transparency to a degree never seen before. Dealer services increasing appear out-of-date. They can track their pizza being made and delivered, but have to call multiple times to learn if their car is ready and then wait at a cashier to pay. Auto retailers need a modern Operating Strategy that deploys technology to deliver the experience consumers expect. We need to simplify delivery models to focus on the key Moments of Truth which determine whether customers return and see unique assets such as loaner vehicles as strategic differentiators to be leveraged, rather than operating expenses to be

Through its work across OEMs, dealers and dealer service providers Empiritas has developed solutions which optimize service performance to obtain the most value from service marketing. Empiritas has executed numerous dealer service specific projects since its inception in 2012 addressing core service performance opportunities. See work samples below:

Drive dealer performance on operational issues that impact service marketing ROI

- Appointment handling

- Selling skills, including unsold follow-up

- ASR strategy & offers

Merchandising & pricing

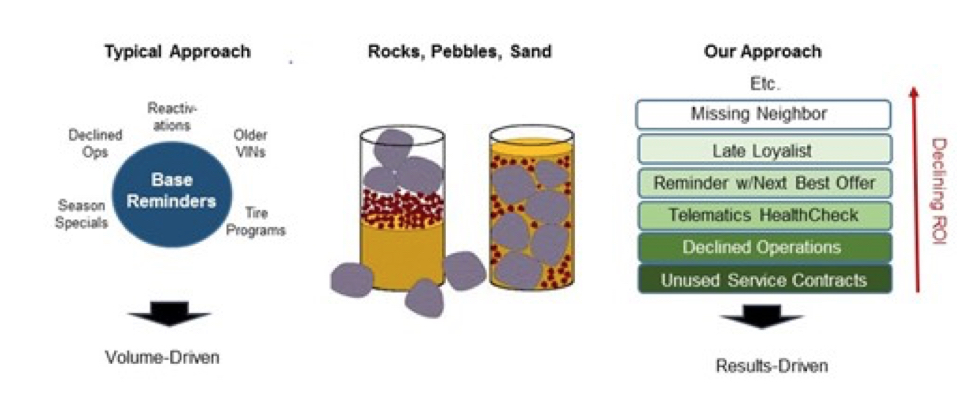

More granular programs can dramatically drive ROI by loading most efficient programs first e.g.

- Contact unsold ops, service contract no shows, etc. first

Prioritize next best segments

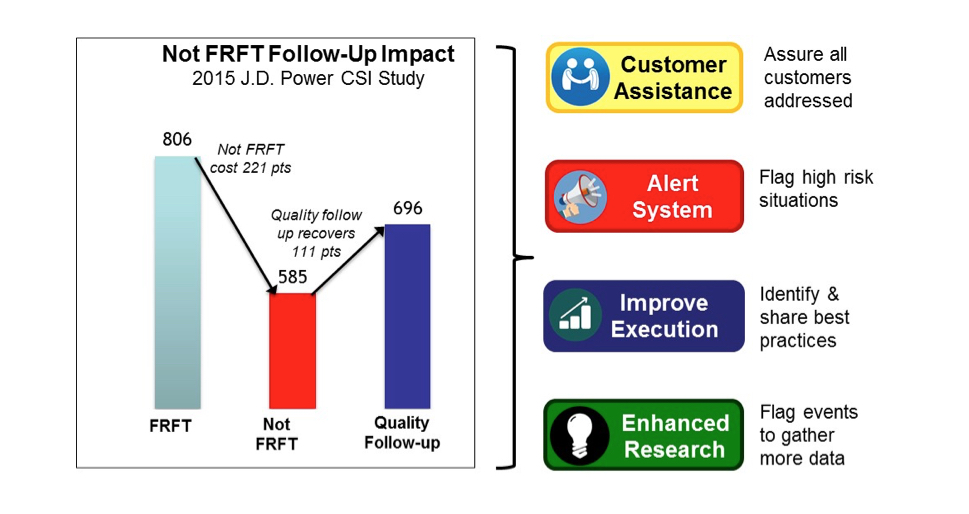

Drive moments of truth by addressing failure root causes and proactive treatment

- Flag high risk situations for special treatment & gather information

Share best practices

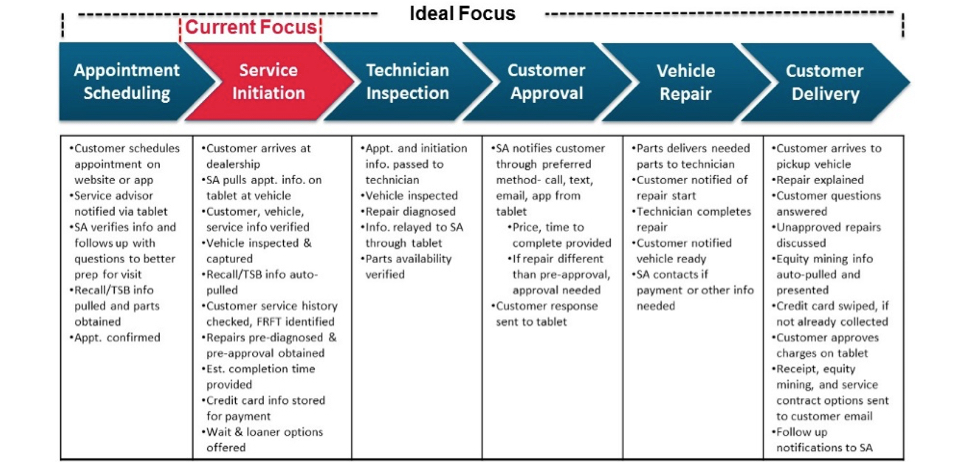

Align technology to deliver repeatable, superior experience leveraging knowledge and automation

- Inform about needs during scheduling

- Gather symptoms prior to visit

- Receive approvals via text

Pay prior to return

Align processes to new consumer expectations

- More self-service – check-in / check-out

- Actively inform & manage time

Adapt offers to consumer preferences

Prepare for vastly different future as technology changes the landscape

- Attract the right talent

- Engage deeper into ownership

- Exploit new technologies

- Maximize service contracts

Plan for AVs

Develop and deploy leading analytics to identify and address service leakage points

Develop and deploy leading analytics to identify and address service leakage points

- Unsold opportunities

- Next best offer

Meet full service requirement

Plan programs to create momentum while addressing structural root causes

References:

OEM. Frank Ferrara, EVP Customer Experiences, Service and Parts, Hyundai Motors

Dealer Solutions. Paul Whitworth. VP Operations, Cox Automotive

Dealership. Mike Maroone, former President, AutoNation

]]>

Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Overview

IT will play a critical role in achieving the business transformation demanded by today’s auto retailing environment. Changing margin structure, growing marketing complexity, an evolving workforce and rising customer expectations are driving toward greater reliance on technology to streamline processes and deliver a superior customer experience while gathering and utilizing data to protect margins.

Industry leaders will not be able to rely solely on off-the-shelf automotive solutions to power their business. Instead they will need to customize and integrate a combination of automotive, global and internal solutions to achieve their goals. Not only will this require increased investments over historic levels, but will require new skills, new partner relationships and new governance to efficiently and effectively manage the investments.

| Issue | Implication |

| Changing Margin Structure | Greater transparency and OEM margin structure assure profit no longer in “deal making” but in optimizing inventory and pricing |

| Growing Marketing Complexity | Optimizing across old and new media requires more sophisticated analysis and management tools |

| Evolving Workforce | Integrate point-of-sale systems to achieve productivity and work environment expectations required to attract new entrants |

| Rising Customer Expectations | Movement toward true eCommerce is inevitable requiring a seamless, on-line / off-line process |

| Streamline Processes | Those who have effectively utilize outsourcing and shared services to achieve scale and skill benefits will have a decisive advantage |

| Superior Customer Experience | High acquisition costs and large differences in value will be place premium on recognizing and tailoring offerings to best customers |

| Gathering and Using Data | With less margin for error, market insight and its application becomes more important |

A. Spending Level and Mix

While most auto retailers have recently increased their technology budgets as business has recovered, most still tend to manage IT budgets as an expense to be minimized, rather than an outcome arising from strategic priorities. The change in mindset starts with recognizing IT serves three distinct purposes and each purpose needs a different management approach. These purposes are: (1) RUN, support for daily business operations, (2) GROW, improvements in current business processes, and (3) TRANSFORM, investments in new business processes and models.

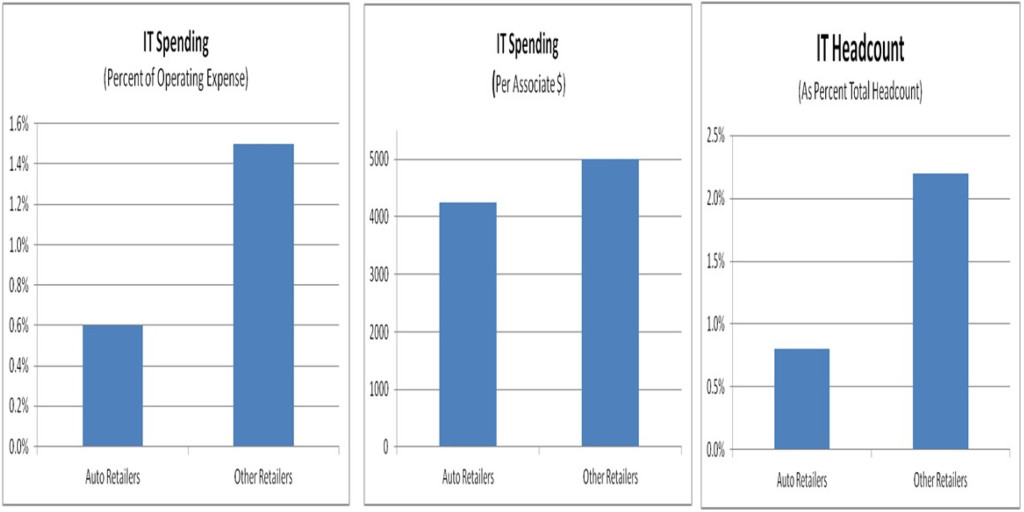

According to Gartner Group benchmarks, most auto retailers trail other retailers in IT spending levels from several perspectives. At the most macro levels, auto retailers under spend as a percent of operating expense, suggesting missed opportunities to create greater operating leverage. In addition, they underinvest on a per associate basis; limiting opportunities to improve associate productivity.

Auto Retailing IT Strategy

A. Overall Spending

All benchmarks are fraught with difficulties. When comparing IT intensity across retail segments, we need to take into account the relative severity of the Great Recession, as well as where the segment is in its transformational lifecycle. While most retail segments have largely recovered from the Great Recession, automotive still remains below 2007 revenues. Therefore, we can expect IT intensity to lag somewhat. In addition, most other retail segments are ahead in the transition from a store-centric to a process-centric business model. So these higher spending levels may reflect either the intense transitional spend, auto is just beginning, or the resultant business model where IT has displaced physical investment and labor.

*Source: Gartner Group and Empiritas Analysis

*Source: Gartner Group and Empiritas Analysis

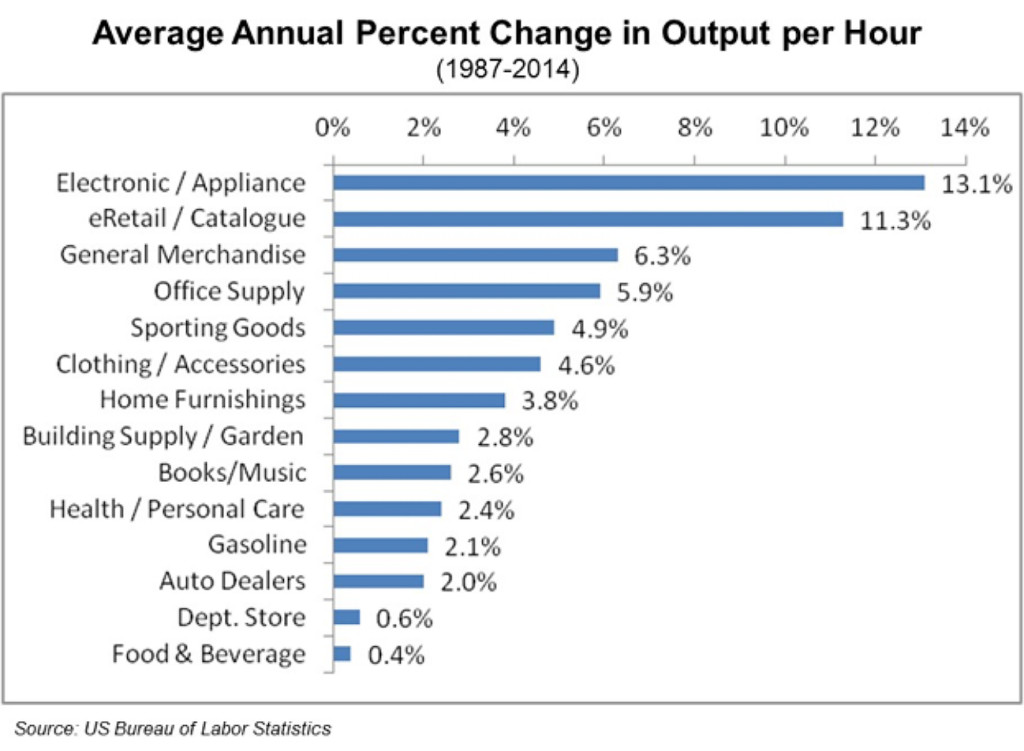

In any case, auto has historically underinvested in technology, and this underinvestment has had consequences on productivity growth relative to other retail sectors. This difference is more than an academic curiously because such a long-term gap drives the segment’s ability to pay and hence compete for talent. An auto retail sales position was a good middle-class job in the 1970s when many of today’s leaders entered the business; many sales people struggle to earn a decent living, contributing to the industry’s high turnover. Furthermore, outdated technology makes jobs less desirable for millennials who often judge businesses based on the technology with which the interact. Some of this is cultural and some very practical because they want relevant job skills. Consequently, the industry is not attracting the talent to execute today’s business, but perhaps more importantly, it is not attracting the talent needed to lead auto retail into the future. Therefore, closing the investment gap is imperative.

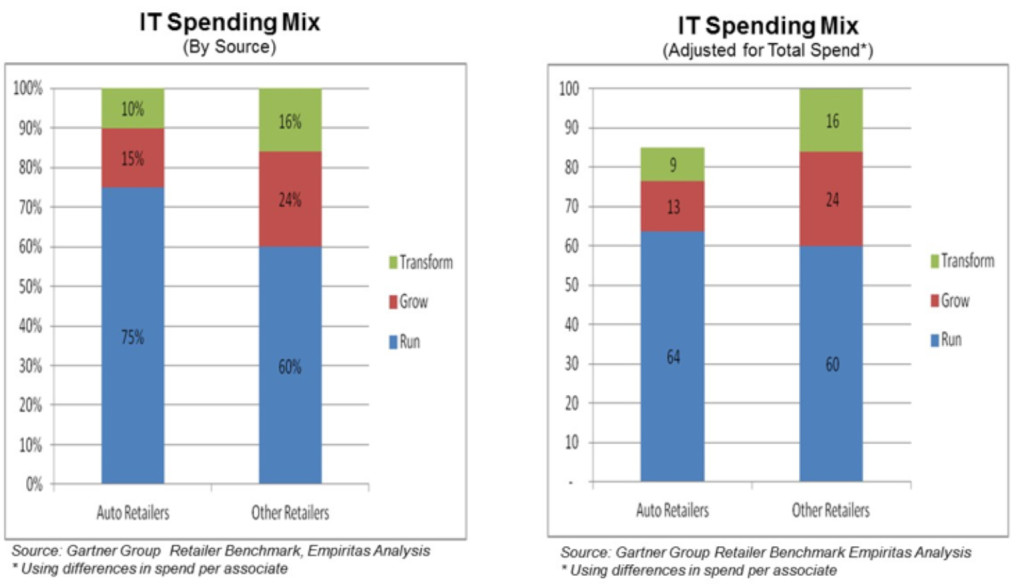

B. Spending Mix

B. Spending Mix

More important than the overall spending gap is the difference in auto retailers’ spending mix compared to other retailers. Gartner categorizes IT spending into three major categories; run, grow and transform. Run includes IT resources focused on continuing operations; such as DMS, data center, core business applications, reporting, telephony and network expenses, usually representing all the non-discretionary expenses. Grow includes developing and enhancing IT systems in support of earnings growth; such as investments to gain operating efficiency, attract more customers or achieve greater revenue per customer. Transform includes costs to enable new business models; such as investments designed to leverage scale and skill above the store level. The auto segment’s spending is heavily weighted toward run, effectively crowding out growth and transformation spending. This has a major impact on the ability to maintain pace with other segments in achieving a competitive cost structure and consumer experience.

Without substantially altering the spending mix from Run to Transform, auto retailers will find it increasing difficult to adopt and develop the date-driven business models which have transformed other retail sectors or create the efficient, tailored and transparent process that consumers expect. Not only does that impact labor productivity, but leads to vastly inefficient use of capital through inflated inventories and lower profit margins through inadequately matching consumers and products and lower customer retention.

C. Managing Run Spending

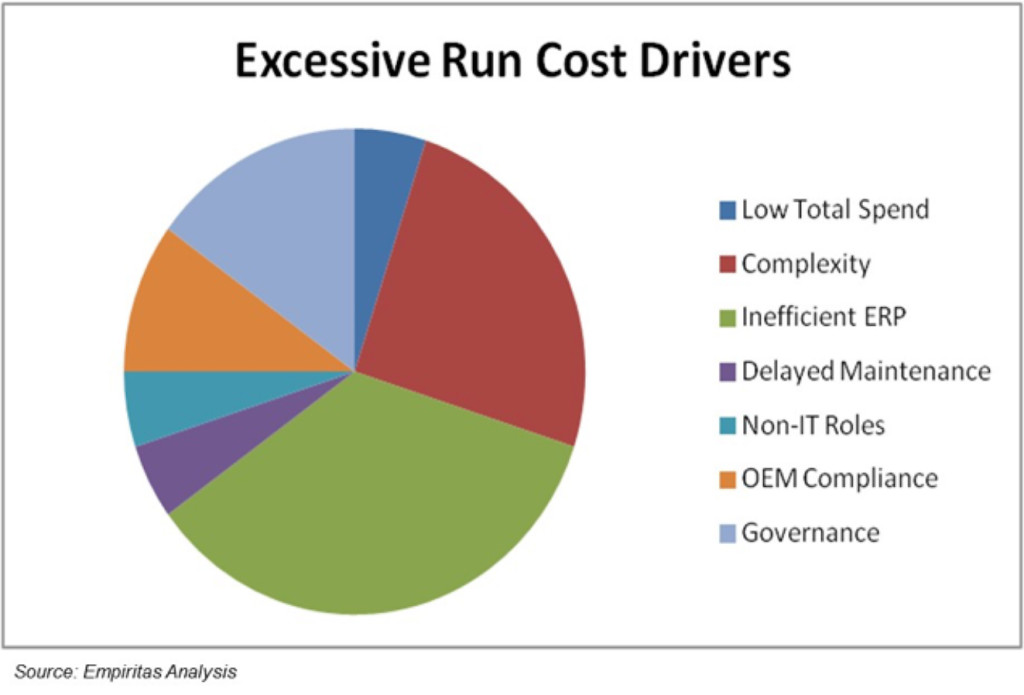

There are several factors that drive the over weighting of run spending compared to other categories. Among those factors are:

- Low Total Spending (5%). Run spending is not discretionary, other than in the very short run, so the spending reductions required to survive the Great Recession were disproportionately borne by delaying growth and transformation initiatives. As normal spending patterns return, run expenses should decline on a relative basis, as discretionary spending increases faster than base requirements.

- Complexity (25%). While most major retailers have consolidated major IT systems, there is often significant variation at the store level. Even when stores share the same application footprint there are often too many point solution providers. This complexity drives support and maintenance costs and slows growth and transform initiatives by requiring custom integration. In addition, the highly customized environment inhibits the ability to take advantage of product upgrades offered by component solutions.

- Inefficient ERP (35%). Most retailers spend less on ERP than auto spends on DMS. In addition, the underlying technology, architecture, and data structure increase maintenance, growth and transformation costs. For example, maintenance and enhancements require specialized developers who command a premium and are difficult to offshore. In addition, the data structure and architecture impose higher direct costs through more complex integration, compared to well-defined APIs; and higher indirect costs are imposed on multiple business partners requiring DMS access. Finally, specialized user interfaces drive higher training costs and slow adoption. While major providers are moving to address, progress remains slow and competition inadequate to drive pricing lower.

- Delayed Maintenance (5%). During the Great Recession upgrades were delayed leaving many systems on unsupported versions. Not only does this cause operating issues and create more failures, but also increases the maintenance and enhancement complexity.

- Non-IT Roles (5%). In many organizations, IT performs functions more appropriately done in operating departments, in part because systems have inadequate administration or content capabilities requiring development talent.

- OEM Compliance (10%). Few retailers face the complexity of OEM compliance standards that directly and indirectly impact costs. By going beyond functional standards to specifying specific solutions, often unique to their brand, they impede the ability for multi-brand retailers to generate scale benefits

- Governance (15%). Productive spending is often crowded out by business requests that do not impact business, particularly with regards to messaging reports or validating data better addressed upstream or in the business unit.

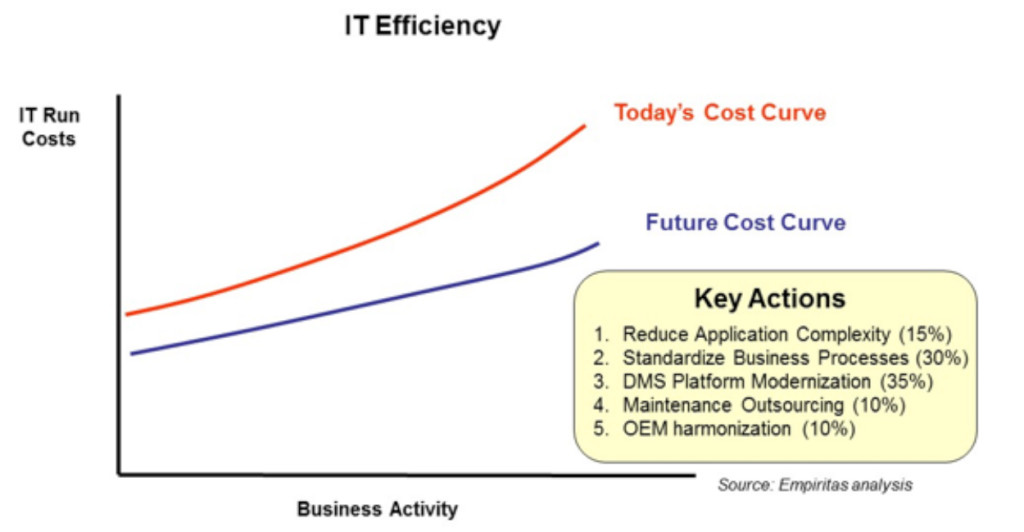

Our goal should be to bend the maintenance curve as a function of business activity, increasing our scale advantage. There are several actions auto retailers can take to impact run costs:

- Reduce business application complexity (15%) by consolidating business solutions around fewer, more capability partners that conform to strategic partner requirements. Auto retailers need to create a store technology template with business driven variation. There need to be explicit standards for hardware, software and network requirements for each store determined by size, brand, and other business characteristics. A concerted effort to drive standardization will lower costs by reducing complexity and duplication, and reduce rates through purchasing leverage. Moving the technology stack to a common, leading platform can exist significantly in this effort.

- Standardize processes and reporting (30%) wherever possible. Reducing the variations in business processes that need to be supported can dramatically simplify IT support efforts. Too often customizations are “free” to the user, so there is no incentive to adhering to a common footprint. Customizations in process need to be restricted to clear business drivers rather than preferences. In addition to IT cost savings, there will be significant operating cost savings, as groups better realize advantages to scale and skill that are currently stymied by excessive variation. There will be a short-term cost to transition to common processes, but the pay-off is usually rapid.

- DMS platform modernization (35%). Each retailer needs to clearly articulate the requirements and hold its DMS provider an internal IT financially accountable to platform improvements that reduce customization and enables plug-and- play environment for other IT partners. In addition, the prevailing per store pricing model limits scale benefits available through an ASP model and is an anachronism dating back to the server based cost structure. Industry leaders should explore alternative pricing models that more equitable share scale benefits and encourage both parties to focus on eliminating non-value added costs.

- Maintenance outsourcing (10%) by bringing applications to common, up-to-date standards maintainable by readily available skills, reducing complexity and improving processes. Few auto retailers have realized the benefits from outsourcing (either onshore or offshore) other retailers have achieved. First, more functions need to be centralized, platforms consolidated and processes standardized, so that outsources would prove profitable.

- OEM harmonization (10%). There has yet to be a concerted effort to quantify the collective impact of OEM mandates on the retail system. All auto retailers and their technology partners have an interest in moving to an approach where OEMs specify capability requirements, but allow retailers to select among qualified suppliers. Properly managed the results would be a greatly enhanced supplier network that could provide a more integrated solution, providing a superior customer experience at a lower cost.

D. Manage Grow Spend

The key to managing Grow Spend is a focus on delivering ROI. ROI delivery starts with a clear strategy that defines how value is created in each business area and determines the required processes and enabling technology to produce profit. The business case needs to be a living document, not just an approval document. Managing Grow execution has many challenges including:

- Operating Strategy Consensus. Because most dealer groups have grown through acquisition or been managed as a loose confederation, there are often wider variances in business practice than dictated by business requirements. The large variance in operating strategy complicates partner selection and IT development by making selection criteria conflicting or excessively broad or requiring significant customization to match each preference. Not only is the customization expensive, absorbing valuable resources which could be deployed against other issues, but often precludes our ability to benefit from upgrades. In addition, our operating strategies are often not sufficiently comprehensive.

- Operating Strategy Completeness. Most dealers look for solutions to immediate problems, rather than a more comprehensive solution taking into account the whole business. This leads to point solutions rather than optimizing an entire workflow. For IT this increases complexity, as point solutions need to be integrated into a single workflow. It also raises costs through system duplication and redundant effort, as most point solutions overtime grow to overlap other solution in pursuit of growth. Operationally, it raises job complexity requiring associates to learn multiple systems, and is often ineffectual as problems solved in one area, create others elsewhere.

- Program Management. Impatience to produce results quickly often leads to too many projects, frequently single threaded through a few key resources and frequently without dedicated program management resources. The result is delays arising from key resource bottlenecks, often without a clear ROI or comprehensive plan to guide priorities. In addition, most auto retailers have limited program management skills that have the experience planning and managing complex change efforts, nor are these skills prevalent among the traditional partner base. To the extent that program management skills exist with auto retailers, they are typically located in IT, and hence there is a bias toward IT development planning with insufficient effort into planning process change, job redefinition, and training.

- Budgeting. Because IT is not usually managed as a strategic resource, there is often no clear linkage between expected business unit operating results and the IT investments required to achieve those results. Today, most business area budgets are set prior to final commitment of the IT budget to specific projects. From an operational standpoint, grow investments should be included in each business area’s budget, not the IT budget. Not only does this drive greater accountability to achieving results from each investment, but also it does not artificially limit IT investments when there may be strong business reasons to continue investing.

- Maximizing Impact. Costs and impact can be maximized by utilizing off-the-shelf technology and leveraging the best practices imbedded in the technology workflow, reducing customization to the few unique attributes that drive business value for the individual retailer. Too often, auto retailers over customized packaged solutions and spend development dollars on preferences or accommodating special cases which may be better handled outside the standard workflow. The bias needs to shift to accept standard best practices. To the extend technology decisions are driven by a clear operating strategy, rather than a desire to add particular features, the more likely the result will be a cost effective solution.

- On-going Project Management. Most companies under invest in on-going project management to assure consistent implementation and business case realization. Clear expectations for roll-out timing and benefit realization milestones need to be set and measured. Deviations need to be understood and investigated to understand systemic from specific issues, so that implementation can precede on as rapid a pace as practical. Individual stores and managers need to be held accountable to realizing the benefit from these investments. While there are many techniques, immediately changing budgets, pay plans and performance expectation to reflect the business case and timing is among the most effective.

E. Manage Transform Spend

Transform spend should be managed similarly to Grow spend, only differing in its breadth and management complexity. Like Grow, Transform spend needs to be clearly guided by an ROI and must be executed by the strongest Program Management talent available to the organization.

- Clear Vision. To be successful, a transformation project needs a well-understood consensus con the future operating structure, including the rationale for change. Identifying and prioritizing all the changes which that must occur, including technology, process, skills, pay plans and partner relationships is by far the hardest aspect of transformational projects and the most likely source of delay and failure.

- Budgeting. Almost by definition, Transform projects are cross-business unit and therefore should be budgeted separately with all participants owning joint responsibility. Given the strategic nature of these projects, they should be shielded from the normal efforts to manage monthly and quarterly results. Only changes in the underlying assumptions that gave rise to the project or new information learned through project execution should alter the project budget, scope or timeline.

- Partners. Because auto retailing trails other retailers in transforming its business model, this is one area auto retailers should strongly consider external solutions. Not only may there be off-the–shelf technology available, but there may be significant opportunities to learn from the pains of other retailers in solution design and change management.

F. Impact of Dealer Services Industry Structure

The Dealer Service’s Industry structure is at the core of the auto retailer’s inability to maximize its return on IT investments. The Dealer Service’s industry is built around industry-specific ERPs optimized for an outdated business model. Therefore, significant effort is required to support more consumer-oriented workflows, particularly in a multi-store, multi-channel environment. These challenges are compounded because the major providers, isolated from competition, did not keep pace with several fundamental technology trends that have transformed solutions in other industries. Among these trends are service oriented architecture and open platforms built on modern languages.

The inability of the DMS providers to adapt in timely fashion has given rise to numerous point solution providers who emerged to solve particular problems with narrow business applications. Recognizing ERP alone would not provide growth; DMS providers expanded into business applications; sometimes through organic investment, but more often through acquisition. Unfortunately, in either case they generally bolted on applications to the existing workflow, rather than re-engineering the workflow. The result is a complex code base that slows development and underperforms leading point solutions. From a user’s perspective this yields inefficient business processes with significant rework and a complicated industry-specific UI that requires unique training. In addition, auto retailers are tasked with spending precious resources on systems integration rather than value added enhancements. Furthermore, the Dealer Service industry overall has locked itself into unique solutions that fail to adequately take advantage of broader IT innovation waves.

Since inherent technology challenges handicapped the DMS providers relative to point solution providers, DMS providers embarked on a strategy predicated on leveraging integration to the dealers’ data resident in the DMS as a source of competitive advantage in business applications. The result has been further inefficiencies as each point solution must pay separately for integration. Not only is this an unnecessary expense, but it interrupts a more natural a workflow outside the DMS; thereby bypassing the archaic DMS workflow. Unfortunately, because DMS provider business applications were constructed or purchased as point solutions, they also do not realize the promise of integrated workflow. Therefore, the integration promised by DMS providers is often no more “native” than those offered by third party point solution providers, only less expense.

DMS provider’s strategy in this space runs counter to auto retailer needs. DMS providers offer a portfolio of often less expensive, yet less capable business applications around an expensive ERP core; while precluding a truly integrated workflow to optimize productivity and customer experience. The industry would be better served by a lower cost ERP that provides an open architecture for retailers to select and integrate point solutions into a superior workflow. Then DMS providers could compete against point solution providers by offering a more comprehensive workflow suite that eliminates the need for a retailer to across multiple providers. Competing on integration across processes, rather than between solutions and the DMS, is the win-win solution these providers need to embrace.

Leading auto retailers have the most to gain from altering the industry structure because the current structure denies them the scale and skill benefits available to other large retailers. Collectively, they have the interest, scale and ability to drive the required changes through concerted pressure on existing providers or injecting new competition into the market.

Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

- In the prevailing low trust environment, consumers often forego needed repairs or suffer buyers’ remorse due to the lack of an objective evaluation regard true service needs.

- Dealers miss over half the available work among VINs serviced because work is not diagnosed or not sold.

- Despite ever more sophisticated diagnostic tools, diagnostics still absorb over 20% of service labor hours and most service outlets struggle to achieve 85% fixed right first time.

- Service marketing efforts are limited to predicting scheduled maintenance and largely silent on more critical vehicle repair needs due to inconsistent inspection data and operation codes.

- US dealers spend over $500 million coding warranty claims and yet still under claim by $1.5 billion. OEMs spend significant efforts monitoring claims to prevent fraud, yet their methods undermine the consumer experience, lose data valuable to solving quality issues and damaging dealer relationships.

The primary reason these challenges have not been addressed lies in the nature of the data. The most valuable data are in the unstructured text fields entered by the service advisor and technician. These fields consist of jargon, short hand and misspelling all unique to a technician or service location. Even much of the structured data – e.g. operation codes or part numbers – are unique to a technician or service location. The inability to aggregate data across multiple sources and intelligently organize has prevented the effective use of big data tools and techniques. That is until now. Empiritas has been working with Ubiquiti, an Ann Arbor based software and analytics company that specializes in transforming text into usable data. Since 2001, Ubiquiti has focused on interpreting warranty and repair order data to assist OEMs and suppliers in driving superior product quality. Ubiquiti has developed proprietary software and techniques to transform the unstructured data found in repair orders into the kind of structured that can be analyzed and quantified. In its core business Ubiquiti serves many major OEMs and Tier One suppliers.

Identify

By recognizing patterns across similar vehicle and utilizing VIN-specific data we are able to more accurately predict vehicle service needs. This enables service marketing to create relevant offers on repair and maintenance items, significantly improving service marketing returns (Bullseye). We also augment efforts to capture unsold operations information. By “reading” the text we recognize customer concerns and causes that were not corrected on a specific repair order (Recapture). Aggregating at the store level, we can assess store performance against an objective standard. We can accurately predict a store’s potential based on its units in operation. We can determine any short falls by source – e.g. VINs not seen, issues not diagnosed, opportunities not sold – and by operation (Shop Scout). Empiritas has been partnering with Ubiquiti to develop and deploy several new applications focused on improving the service business. Working together they have developed several new products which leverage big data to deliver superior performance in four critical service management functions; identify, notify, recognize and realize.

Notify

We can power any number of service marketing applications designed to inform consumers about their service needs. Our most powerful application, we call Vehicle MD. Vehicle MD is a consumer self-diagnostic tool that allows a customer to input information about vehicle problems experienced in natural language. The solution returns likely issues and solutions in the same natural language, giving the consumer confidence in service writer recommendations. The solution helps bridge the trust gap which undermines the current owner / service provider relationship.

In addition, we work with service marketing companies to better inform service reminder campaigns, smart phone service applications and other efforts to reach consumers with more relevant message at the time of need.

Recognize

We combine vehicle-specific data and similar-vehicle data to determine the likelihood that vehicles experiencing certain symptoms are likely to have other service needs. We call this recognizing “co-occurring issues” (Service Check). This solution is a significant enhancement on multi-point inspections. Rather than place all vehicles through the same 125-point inspection, we guide technicians to the most likely issues; improving compliance and yield. We encourage clients to be transparent and provide consumers with the same view on likely issues. Showing consumers a “people-like you” view of service needs, helps drive sales conversion and long-term credibility (Verify).

Realize

We provide technicians with the most likely robust fixes based on customer concern and diagnostics output. In effect, we present each technician with the collective wisdom of all technicians who have worked on similar vehicles. The feedback is immediate without the need to consult bulletin boards, reach TSBs or call master technician hotlines. Because the solution is authored by the real-time data, as soon as some technician has solved the problem, his wisdom is immediately available to all. This creates significant value early in model years, on hard to diagnose problems or less common models. (Tech Forum). Part of realizing value is getting paid. As mentioned above, warranty administration is a very burdensome process that equals 3% of the total warranty cost for the industry. We have developed a solution that largely automates the warranty admin; pre-populating OEM required fields from the original RO, selecting or narrowing codes and identifying potential missed claims. Our current solution reduces claims effort by over 80% and finds 3-4% in unclaimed work. For a typical dealer this represents nearly $60,000 in annual value.

Results

The net result is we have leveraged our knowledge of the barriers to improved service performance to open new revenue sources for Ubiquiti. We have worked collaboratively to define the requirements, identify potential customers and used trusted relationships to quickly bring solutions to market. Conservatively, these new revenue sources will double Ubiquiti’s revenue over the next three years.

]]>Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

On June 15, 2014, Lithia (symbol: LAD) announced the acquisition of DCH Auto Group for $362.5M for $340M in cash and $22.5M in LAD stock. While Lithia has enjoyed a 23% rise in stock price as of June 30th, we believe there is considerably more upside to Lithia stockholders.

DCH brings Lithia scale and brand/geographic diversification. DCH’s 27 dealerships are all located in the two largest automotive markets in the US, NY/NJ (13 dealerships) and Southern California (14 dealerships). The mix of dealerships includes:

- Luxury: 2 BMW, 2 Lexus, and 2 Audi

- Import: 7 Toyota, 11 Honda/Acura, 1 Nissan, and 1 Kia

- Domestic: 1 Chrysler Jeep Dodge Ram

Our Perspective

Lithia expects the DCH acquisition to add $0.65-$0.75 to EPS, annualized. With 23.5M LAD shares outstanding, $0.70 EPS implies the DCH dealerships are profiting $16.5M annually or $611k per dealership.

According to the National Automotive Dealership Association (NADA), in 2013 the average dealership’s ‘Net Profit before Taxes’ was $923,248. At a 30% tax rate, the average dealership’s after-tax Net Profit is approximately $646k. Therefore, despite an attractive brand mix and large stores in major metros, DCH trails the average store profitability, suggesting significant profit improvement opportunity.

With the acquisition, LDA announced DCH would add approximately $2.3B revenue, or $85.2M per dealership. This places the average DCH dealership over twice as large as the national average. With only $611k in net profit per store, DCH’s margins are less than half the industry average and significantly below not only LAD, but also AutoNation which has a more similar brand and geographic footprint.

| Group | Revenue ($) | Net Profit ($) | Net Profit : Revenue |

| Lithia | 4.0B | 106M | 2.65% |

| AutoNation | 17.5B | 375M | 2.14% |

| Top 4 Public Retailers | 50.0B | 815M | 1.63% |

| NADA average | 41.3M | 646k | 1.56% |

| DCH | 2.3B | 16.5M | 0.72% |

Implications for LDA

LDA announced the DCH acquisition would add $0.65-$0.75 EPS annually. We believe these numbers reflect current, DCH margins, not the potential LAD is likely to drive from these same assets. If DCH can improve operations and margins to reach peer benchmarks, there is EPS gains from the deal could be $1.50-$2.60.

|

DCH margin improvement |

DCH addition to EPS |

LDA EPS |

EPS % Increase |

|

| LDA | 369% | $2.58 | $6.70 | 63% |

| AutoNation | 298% | $2.09 | $6.21 | 51% |

| Top 4 | 227% | $1.59 | $5.71 | 39% |

| NADA average | 218% | $1.53 | $5.65 | 37% |

LDA Share Price

LDA stock close on June 13, 2014 (Friday before announcement) was $76.68. The stock closed on June 16, 2014 (Monday after announcement) at $86.53 or 13% higher than prior the announcement. This 13% increase is close to the announced increase in EPS. LDA EPS was $4.12 and DCH would add $0.70 EPS or a 17% additional EPS.

Since then, investors appear to be recognizing the potential upside for LDA. The stock closed June 30, 2014 at $94.07 or a 23% increase since prior to deal announcement.

Given the potential opportunities described above, there should still be upside in LDA stock of 37-63% from before the announcement or $105-125 per share. In terms of driving profitability, LDA performs best in class and has a history of successfully integrating acquisitions, rapidly bringing operations to LAD standards. While this acquisition is larger and brings new challenges related to new geographies, we have confidence in LAD management to drive performance improvement over time.

Other considerations

There are other operational synergies and cost savings that should come from the increased scale and scope that should improve the performance of LAD’s existing operation that are not included in this analysis, representing further potential gains. Access to additional trade-ins to fuel used vehicle performance

- Access to additional trade-ins to fuel used vehicle performance

- Negotiate better terms with financial institutions and F&I product providers

- Improve scale in purchasing, technology and back office operations

Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Today, there are many beliefs surrounding digital marketing, leading to divergent practices. In fact, Automotive News is littered with best practice stories each week that contradict the best practice stories from the previous weeks. Each vendor touts the incremental sales yielded by its narrow solution, while spending rises faster than sales, as multiple vendors compete to claim the same sales. No one has provided dealers with a comprehensive framework that links digital spending allocation, web presence strategy, and sales execution to final sales and profits. Without a clear, comprehensive, data-driven framework dealers flounder, wasting precious marketing spending and spoiling significant percentage of the opportunities created by OEM marketing.

Given the importance digital plays in the overall automotive business, helping dealers better understand digital marketing and make better marketing and operating decisions would have significant impact on OEM sales.

- Digital and direct marketing now above 50% total dealer marketing spend for many dealers

- 1/3 sales originate directly from digital leads

- 1/2 the remainder are significantly influenced by their digital experience – e.g. selected dealer or brand based on on-line shopping

- 2x variances in digital close rates on similar leads and brands are not unusual in a dealer group, let alone across a dealer network

The challenge is how can an OEM create such a framework for its dealers and provide dealers with a comprehensive scorecard with recommendations to drive digital performance. We have been working on a comprehensive evaluation and change management activity which we have named “Digital Edge.

Digital Edge

Digital Edge consists of a comprehensive evaluation of each dealer’s digital activities and their impact on the dealer’s business and an action plan that helps dealers prioritize investments and activities. The package should include dealer follow-on visits and targeted training sessions based on the findings and progress. While OEMs may need to subsidize to drive dealer participation, dealers needs some “skin in the game” in terms of investments and accountability to results to promote success.

Evaluation

Based on our experience, we break the framework into the following pieces which drive overall digital effectiveness:

- Spending mix and measurement

- Web presence

- SEM alignment

- Lead handling

Spending Mix and Measurement The old adage about half the advertising working and the other not, but not knowing which is which, rings true for digital. Dealers are not clear about how to measure, let alone what represents a good job. We would recommend clarifying for dealers how each digital marketing element contributes to the overall marketing agenda and how best to measure results. For example, on-line classifieds can be best measured by $ per detailed page views, while third party lead providers should be viewed in terms of $ per sale, or better yet, % gross margin delivered.

Once measurements are established, we can gather data across the network to establish standards across elements. This would help dealers make comparisons regarding overall spend, nudging traditionalists toward more effective approaches. In addition, we would give dealers a benchmark to assess their effectiveness on individual elements, providing fact-based evidence on vendor performance to guide selection and improvement discussions. With sufficient sample, we could regress overall spending effectiveness with various spending mixtures to help identify the optimal digital marketing “cocktail”, as well as any unique best practices.

Web Presence Strategy We have recognized several major flaws in Tier 3 web presence strategies which need to be addressed through fact-based best practices. First, many dealers do not understand how to evaluate and populate websites. They are comfortable with a cluttered “Sunday newspaper ad look & feel” that undermines SEO and consumer usability. We have seen examples where dealers have significantly degraded otherwise well-performing platforms through add-ons. Secondly, the linkage between OEM and dealer sites are not seamless, forcing users to repeat search or re-enter information. Third, dealers do not properly price on-line. Operating from fear rather than fact, they either post MSRP or below market prices, when consistent, transparent pricing yields superior growth and gross. Finally, many dealers do not have a well-defined Social Media strategy that focuses on building on-line reputation.

We would recommend a comprehensive audit of dealer web strategy, combining analytics with objective evaluations. For example, we would review all sites, including linked to key OEM sites, based on cross-industry best practices, showing each dealer the results along with screen shots highlighting practices. We would correlate these results with measurable results including competitive traffic comparisons, market search share and native leads share. Through these facts, we would guide dealers to better decisions regarding platform choice and implementation.

We would evaluate dealer on-line pricing strategy because this is a key driver of traffic conversion. In pilot, we sample key products, reviewing prices on dealer websites and major listing services. At scale, we can screen scraping capabilities which could be implemented to more systematically test pricing and leave dealers a capability to optimize pricing going forward. Leveraging PIN data, we could demonstrate to dealers pricing strategies that best balance growth and gross.

At last year’s NADA, we reviewed the various Social Media and Reputation Management software and services. Based on our observation, we recommend dealers create a defined process that focuses heavily on maximizing review captures (good and bad) over those tools designed to selectively solicit good reviews. In addition, dealers need a capability to centrally manage a variety of social media focused predominantly on building reputation, not sales, by celebrating community involvement, successes and milestones of associates and customers. We would review each dealers reputation and social media efforts, correlating activity to business metrics, such as repeat purchases and referral sales.

SEM alignment While dealers have significantly increased their SEM investments in the past few years, few are aware of the opportunities to improve yield through aligning search terms, ad copy and landing page copy. Evidence suggests improving alignment and relevance can drive a two-fold improvement in lead creation. While achieving that result level would require new website technology platform, there are significant differences among existing dealer website and SEM provider platforms. Therefore, raising dealer awareness regarding the issues and opportunities should drive dealers to the most capable platforms available.

We would conduct an alignment audit by testing several key search terms where we know content alignment has greatest impact – e.g. leasing deals, lowest price, best offers, high value option package, or key model variant. We will show dealers their results compared to best practices and provide an overall results by platform to aid in vendor selection.

Lead Handling The largest drop-off and area of greatest variance is the on-line / off-line interface. We recognize that changing consumer behavior, evolving on-line tactics and growing transparency dictated constant monitoring with significant changes in handling best practices every few months. Many dealers are still executing pre-transparency tactics that limit information prior to visit or withhold pricing. It is amazing how few dealers have optimized around the most basic and accepted practices, e.g. answering all leads in under 10 minutes, let alone implement more forward-looking practices such as providing price comparisons or content rich responses.

We would recommend pulling data from the CRM so that we can construct a lead waterfall for dealers. We can then identify and quantify systemic and dealer-specific leakage points. We would conduct an Internet buyer/rejecter study to identify and prioritize key performance, such as response time, response quality, and pricing strategy. We will utilize in-store audits to gain further insights into best practices such as organization structure, tools and templates, pay plans and talent management.

Change Management

Action Plan The most critical outcome is a dealer-specific action plan tied to the evaluation. Because the evaluation elements are linked to business results, we will be able to prioritize actions to financial outcomes. The action plan should be composed with input from the key operating managers, such as the Internet Manager, in order to generate buy-in and in best cases, be presented jointly to the General Manager and Dealer Principal. Action plan elements need to be tracked and reviewed by field representatives during their store visits. This will require deploying some account management software, if one is not currently deployed, and significant effort training field representatives in discussing digital best practices.

Consulting Most dealers will need assistance on a variety of issues to drive the changes throughout the organization. Driving sustainable change will require several in-store interactions whose focus will depend on each dealer’s issues. It could involve helping dealers select more robust partners, review pricing strategy or install a new lead handling process, so the content needs to remain fluid based on each dealer’s need. These interactions should continue until each dealer achieved its goal.

]]>Notice: compact(): Undefined variable: limits in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Notice: compact(): Undefined variable: groupby in /home2/empirita/public_html/wp-includes/class-wp-comment-query.php on line 863

Then megadealers emerged. Initially their value proposition was driven by exploiting the difference between private and public earnings multiples. They were roll-ups fueled by a rising stock market and cheap debt. Over time, these large enterprises built on the financial gains by consolidating sub-scale store back offices and utilizing buying power to improve costs. Central capabilities in technology, process design, training and talent management were developed to create and deploy best practices at the store level. They benefitted from more consistent performance across the portfolio. However, the store remained the fundamental economic unit; albeit against some tighter standards and reduced scope of activity.

There is an emerging model that recognizes the potential from placing the consumer at the center of the enterprise to create the shopping and lifetime ownership experience that can only executed by a group with significant local brand density. Corporate takes responsibility for customer communication and offer development, so that consumers can move seamlessly between brands. Brands are recognized for their enterprise value. Consumers are already behaving this way online. It takes place on third party sites, outside the dealers’ control. In this model, stores can be dramatically simplified and re-purposed, as eCommerce departments, BDCs, inventory management and pricing moves to a central location. Centralizing leverages scale, expertise and incentives based on optimizing the enterprise, rather than individual store performance. The store’s purpose becomes solely to deliver in-person brand sales and service experience. The consumer and enterprise become the fundamental economic unit.

Successfully adapting to this change involves breaking tightly held beliefs and practices. The transition will not be easy and needs to be carefully planned and sequenced. However, the resulting economics are very compelling. Scaled efficiencies can be achieved in operating, as well as back office tasks. More importantly, the new processes and offers result in dramatically higher close rates, price realization and customer retention than can be achieved in single store, portfolio or holding company model.

]]>